Inflation Scaremongering

DaveSchmidt said:

What convinced you that, in order for dampening demand to lower inflation, demand has to be excessive?

To add, it is about better matching supply and demand - taking them out of imbalance.

If you can’t raise supply, you reduce demand.

DaveSchmidt said:

drummerboy said:

I have not seen evidence of excessive demand - so how can dampening demand lower inflation?

What convinced you that, in order for dampening demand to lower inflation, demand has to be excessive?

well, I believe that the standard thinking is that you raise rates when demand is excessive. Right?

If there is slack in the demand/supply relationship, reducing demand might not do very much, other than screw up the economy.

Also, how does raising rates deal with the apparent price gouging that's going on? i.e. record profits

Anyway, I'm afraid that the Fed is going to get credit for lowering inflation when in fact we've been on a downward trend already.

drummerboy said:

well, I believe that the standard thinking is that you raise rates when demand is excessive. Right?

If there is slack in the demand/supply relationship, reducing demand might not do very much, other than screw up the economy.

Also, how does raising rates deal with the apparent price gouging that's going on? i.e. record profits

Anyway, I'm afraid that the Fed is going to get credit for lowering inflation when in fact we've been on a downward trend already.

No, you raise rates when there is an imbalance between supply and demand, causing price inflation.

To mitigate the imbalance, since the Fed cannot raise supply, it reduces demand by raising interest rates.

Further, to your gouging point, if there is less demand, there is less leverage for companies to raise prices, because the goods will sit on the shelf.

drummerboy said:

sez you

Sez the Fed and the economic numbers. I'm not just making **** up here.

Until just a week ago the expectation was a 0.5% increase in the Fed funds rate.

They raised it 0.75% based upon a higher-than-expected inflation report that came in on Friday.

https://finance.yahoo.com/news/may-inflation-data-june-10-2022-212834308.html

Somebody on social media doesn't understand something and, dammit, nobody's going to make him.

jimmurphy said:

drummerboy said:

sez you

Sez the Fed and the economic numbers. I'm not just making **** up here.

Until just a week ago the expectation was a 0.5% increase in the Fed funds rate.

They raised it 0.75% based upon a higher-than-expected inflation report that came in on Friday.

https://finance.yahoo.com/news/may-inflation-data-june-10-2022-212834308.html

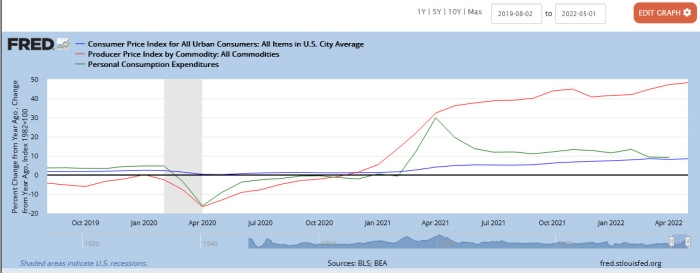

it depends on what you measure. as I pointed out in an earlier post, which you ignored.

PCE vs CPI

As Drum pointed out in that post, PCE is the Fed's preferred metric, which makes you wonder WTF they're actually thinking.

Would love to see the economy under fed chair drummerboy. "Hm okay, 8.6% inflation. But I don't see how raising rates will lower inflation. I also don't know what else to do. Well let's do nothing I guess. And maybe we think about rolling back previous rate increases next time. Meeting adjourned."

I think the Fed doing nothing would have been a fine idea. Instead we're likely to get unnecessary increased unemployment, as our inflation naturally headed downward. (hint, look at the chart)

As mentioned previously, that was exactly what the Fed did late last year, only inflation didn't naturally head downward - it unnaturally headed upward. So again they'd just be doubling down on a losing bet.

Maybe it wasn't time for it to trend down naturally.

have you looked at the chart?

BTW, even if last year's stimulus goosed inflation, that stimulus is well worn away by now, so what's causing it now?

The Fed is clearly acting politically - not economically.

DaveSchmidt said:

Somebody on social media doesn't understand something and, dammit, nobody's going to make him.

Reminds me of this guy:

then there's this:

Democrats Eye Wall Street Rule to Fight Inflation

I don't know if that's accurate, but it seems plausible. And I do seem to remember short term spikes in food prices over the past several years as a result of commodity speculation.

I don't pretend to be an expert on any of this. Which is why I don't understand why anyone can act so sure of themselves either in opposition or support of the latest Fed increase. I don't see where even the supposed experts seem to know what they're doing, or what the likely result of their actions will be. I can find experts to support a whole array of well-thought out arguments for why the Fed should have or should not have done what they did.

So the Fed has a hammer, and no other tools. They felt the need to do SOMETHING. So they swung their hammer. Will it actually rein in inflation? Who knows? Will it send the country into recession? Who knows? Will unemployment go back up? Who knows?

All of us regular non-economist folks just have to passively hope the experts know what they're doing.

meanwhile, banana prices are holding steady. probably the best buy in the supermarket right now.

but the price of Doritos seems to be tracking the price of premium gas. almost $6 a bag.

drummerboy said:

Maybe it wasn't time for it to trend down naturally.

have you looked at the chart?

i have. And I think it's just confirmation bias on your part. I don't see how anyone can rationally think the minor downward drift in PCE trumps many months of CPI running *way* above the Fed's 2% inflation target (and peaking in the last reading).

drummerboy said:

Maybe it wasn't time for it to trend down naturally.

have you looked at the chart?

That spike in PCE in from February to April 2021 stands out. Any ideas what contributed to it?

DaveSchmidt said:

drummerboy said:

Maybe it wasn't time for it to trend down naturally.

have you looked at the chart?

That spike in PCE in from February to April 2021 stands out. Any ideas what contributed to it?

beats me. it's not the spike so much, it's the big divergence between CPI and PCE that stands out to me.

Smedley said:

drummerboy said:

Maybe it wasn't time for it to trend down naturally.

have you looked at the chart?

i have. And I think it's just confirmation bias on your part. I don't see how anyone can rationally think the minor downward drift in PCE trumps many months of CPI running *way* above the Fed's 2% inflation target (and peaking in the last reading).

How is looking at numbers on a graph confirmation bias?

drummerboy said:

BTW, even if last year's stimulus goosed inflation, that stimulus is well worn away by now, so what's causing it now?

The Fed is clearly acting politically - not economically.

just how is the fed “clearly” acting politically?

For one, the fed is independent, at least theoretically. Two, Powell is a Republican who trump named Fed chair. Are you saying the Powell-led Fed is working to keep the Democrats in power?

Smedley said:

drummerboy said:

BTW, even if last year's stimulus goosed inflation, that stimulus is well worn away by now, so what's causing it now?

The Fed is clearly acting politically - not economically.

just how is the fed “clearly” acting politically?

For one, the fed is independent, at least theoretically. Two, Powell is a Republican who trump named Fed chair. Are you saying the Powell-led Fed is working to keep the Democrats in power?

how is trashing the economy gonna keep Dems in power?

what?

Did you see the chart on how the Fed raises rates during Dem admins and lowers them during Rep ones?

drummerboy said:

Smedley said:

drummerboy said:

Maybe it wasn't time for it to trend down naturally.

have you looked at the chart?

i have. And I think it's just confirmation bias on your part. I don't see how anyone can rationally think the minor downward drift in PCE trumps many months of CPI running *way* above the Fed's 2% inflation target (and peaking in the last reading).

How is looking at numbers on a graph confirmation bias?

because that particular graph is a fart in the wind of overall inflation numbers.

drummerboy said:

Smedley said:

drummerboy said:

BTW, even if last year's stimulus goosed inflation, that stimulus is well worn away by now, so what's causing it now?

The Fed is clearly acting politically - not economically.

just how is the fed “clearly” acting politically?

For one, the fed is independent, at least theoretically. Two, Powell is a Republican who trump named Fed chair. Are you saying the Powell-led Fed is working to keep the Democrats in power?

how is trashing the economy gonna keep Dems in power?

what?

Did you see the chart on how the Fed raises rates during Dem admins and lowers them during Rep ones?

Ok that clarifies things, kind of. So when you say the fed is acting politically, you’re saying the fed is working against democrats ?

Smedley said:

drummerboy said:

Smedley said:

drummerboy said:

BTW, even if last year's stimulus goosed inflation, that stimulus is well worn away by now, so what's causing it now?

The Fed is clearly acting politically - not economically.

just how is the fed “clearly” acting politically?

For one, the fed is independent, at least theoretically. Two, Powell is a Republican who trump named Fed chair. Are you saying the Powell-led Fed is working to keep the Democrats in power?

how is trashing the economy gonna keep Dems in power?

what?

Did you see the chart on how the Fed raises rates during Dem admins and lowers them during Rep ones?

Ok that clarifies things, kind of. So when you say the fed is acting politically, you’re saying the fed is working against democrats ?

no. I'm not saying they're being partisan (though they may be. who knows?) Political does not necessarily mean partisan. I'm just saying they're not acting based on what the economics of the situation says they should do.

And just because I think what they're doing is wrong, it doesn't mean I think they're stupid, or that they don't know what they're doing. They know exactly what they're doing.

drummerboy said:

beats me. it's not the spike so much, it's the big divergence between CPI and PCE that stands out to me.

It's a mirror reflection of the steep drop exactly one year earlier. The lower the PCE in 2020, the higher the percentage gain when prices rose in 2021, because these are year-over-year rates. Likewise, the higher the PCE a year ago, coming off that peak, the lower the year-over-year percentage gain now.

CPI isn't being compared with a spike and its aftermath the way PCE is. Hence, at least part of the reason for the current divergence.

Why PCE and CPI parted so sharply at the start of the pandemic, where the divergence originated, I don't know.

Here's a good piece by Dean Baker, pointing out that, as per Powell, part of the reason they went for such a huge increase is because the public's expectations are that inflation will persist and go higher. Of course, the public is clueless about inflation's causes, so why are they thinking this?

Maybe it's the scaremongering by the media on inflation.

Just a thought.

drummerboy said:

Smedley said:

drummerboy said:

Smedley said:

drummerboy said:

BTW, even if last year's stimulus goosed inflation, that stimulus is well worn away by now, so what's causing it now?

The Fed is clearly acting politically - not economically.

just how is the fed “clearly” acting politically?

For one, the fed is independent, at least theoretically. Two, Powell is a Republican who trump named Fed chair. Are you saying the Powell-led Fed is working to keep the Democrats in power?

how is trashing the economy gonna keep Dems in power?

what?

Did you see the chart on how the Fed raises rates during Dem admins and lowers them during Rep ones?

Ok that clarifies things, kind of. So when you say the fed is acting politically, you’re saying the fed is working against democrats ?

no. I'm not saying they're being partisan (though they may be. who knows?) Political does not necessarily mean partisan. I'm just saying they're not acting based on what the economics of the situation says they should do.

And just because I think what they're doing is wrong, it doesn't mean I think they're stupid, or that they don't know what they're doing. They know exactly what they're doing.

Well this is all pretty cryptic. The fed is “clearly” acting politically, but not necessarily in a partisan way. They’re not acting based on economics, yet they know exactly what they’re doing.

It’s gobbledygook . Either you’re writing a script for a bad Washington-meets-Wall Street thriller movie, or you’ve been drinking. Or both.

Sponsored Business

Promote your business here - Businesses get highlighted throughout the site and you can add a deal.

What convinced you that, in order for dampening demand to lower inflation, demand has to be excessive?