Pope Francis, Catholics, and Christians in the news worldwide

joanne, i probably was unclear while trying to be funny. i only meant to say that so many over time have been so far from living up to the standards set in (anyone's) scripture that it's as if the standards only apply in some other world. i hope no offense please??

Absolutely no offense over here, just thought I’d do a little more research since I had the time  (13 years at a Methodist school have to be useful sometimes in this Jewish girl’s life)

(13 years at a Methodist school have to be useful sometimes in this Jewish girl’s life)

OK. I’m off to collect the husband from the train station.

Fascinating excerpt from one of Joanne’s links above:

“At the Jewish Educational Loan Fund, a nonprofit that provides no-interest loans to low-income Jewish students to attend college or graduate school, leadership is using the Shmita year as an opportunity to provide debt relief for some of its borrowers.

“The organization already has some experience with debt cancellation. Last year, a foundation in California was looking to find ways to forgive debt and they provided funding to JELF to relieve some of its borrowers, said Jenna Shulman, the organization’s chief executive officer.

“For its Shmita campaign, JELF is hoping to raise $300,000 — including $150,000 in matching gifts from two donors — for debt cancellation. Shulman said the beneficiaries of the relief need to have an adjusted gross income of less than $125,000 and a debt-to-income ratio of at least 35%. The organization hopes to be soliciting applications for relief by early 2022, Shulman said. The group expects to cancel the debt of at least 24 borrowers.

Shmita as a check on society

“For some activists, Shmita is not only a reminder of what individual organizations can do to create economic and environmental justice, but an opportunity to consider how to reshape society more broadly to achieve those goals.

“While the Bible recognizes that we live in a capitalist society, it also recognizes that if that capitalist society goes unchecked then very bad things are going to happen,” said David Krantz, a doctoral candidate at Arizona State University and co-founder of Aytzim, a Jewish environmental nonprofit. “It needs to be checked and checked on a regular basis.”

“Still, one-time debt relief isn’t enough to provide the reset that Shmita promises, he said.

“Yes, we need to release debt, but we need to be thinking also about why people are getting into so much debt and what we can do differently in society to help manage that,” he said.

Debt ‘Jubilees’ also come from the Bible

“The Debt Collective, an organization with roots in Occupy Wall Street, has been pushing for debtors, creditors, government officials and others to re-think debt’s role in our society for years with a nod to the biblical concept of the Jubilee, a period of debt forgiveness that occurs every seven Shmita cycles, or once every 50 years.

“In 2012, the organization started the Rolling Jubilee, an initiative to buy up medical debt and cancel it, later expanding the concept to student debt from for-profit colleges. Earlier this year, the Debt Collective launched the Biden Jubilee 100, a campaign to push President Joe Biden to cancel all outstanding student debt”.

Don’t recall hearing or reading about the Biden Jubilee. But, does anyone know, or may have read, how many students might qualify following the halt in payments over the last three pandemic years?

Is this $10,000 a one time reduction in student debt for students currently enrolled? Will future students, who fall behind in their debt payments, become eligible for debt relief?

Will college graduates who paid their loans be compensated? Of course, they would have a sterling credit rating.

There are many people who have mortgages they are struggling to pay — how can the government relieve that crushing burden?

These apolitical questions are from a senior citizen who is trying to understand the pluses and minuses of this executive action, not a fight.

I confess my narrow understanding of high finance, but might the government be remiss in not targeting the universities which feel the sky’s the limit re tuition costs?

I am a big supporter of community colleges — never more so when the full impact of school closures on K-12 students, and their learning losses have been tallied.

mtierney said:

These apolitical questions are from a senior citizen who is trying to understand the pluses and minuses of this executive action, not a fight.

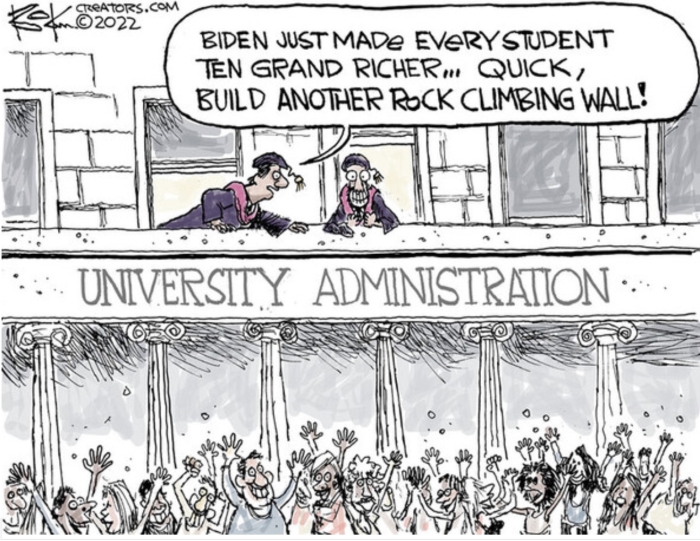

If you are trying to be apolitical, why did you include a political cartoon?

tjohn said:

mtierney said:

These apolitical questions are from a senior citizen who is trying to understand the pluses and minuses of this executive action, not a fight.

If you are trying to be apolitical, why did you include a political cartoon?

How is the cartoon political? It is a slap at ridiculously high college tuition rates!

mtierney said:

tjohn said:

mtierney said:

These apolitical questions are from a senior citizen who is trying to understand the pluses and minuses of this executive action, not a fight.

If you are trying to be apolitical, why did you include a political cartoon?

How is the cartoon political? It is a slap at ridiculously high college tuition rates!

It mentioned Biden's debt relief pronouncement. Therefore, it is political.

Dumb cartoon aside...

Supposedly, it will affect around 20 million borrowers. Around 8 million of those already have their information on file with the Dept of Education, and will be eligible for automatic student loan forgiveness, if they qualify.

Payments will resume for everyone who still owes money on January 1st, 2023.

Those who do not have their information on file will have to apply for loan forgiveness, and are encouraged to do so before November 15th, so they can receive their loan forgiveness before payments kick back in again in January. They (DoE) expect loan forgiveness payments to take 4-6 weeks to process.

Pell grant recipients will receive up to $20k. Non Pell grant recipients will get up to $10k. Others may apply to have all their student loans forgiven through the Public Service Loan Forgiveness program if they are eligible.

This is a one-time payment.

From mtierney's list of questions...

"Will future students, who fall behind in their debt payments, become eligible for debt relief?"

Not at this time. But the Biden admin is working on ways to make repaying loans less of a burden, such as halving the mandatory percentage of discretionary monthly income borrowers have to pay, and changing the rules to raise the hard floor for mandatory loan payments so borrowers who aren't earning a ton of money at the start of their careers don't have to make payments until they start earning enough money to do so.

"Will college graduates who paid their loans be compensated?"

Nope.

"There are many people who have mortgages they are struggling to pay — how can the government relieve that crushing burden?"

While it is clearly underfunded, the American Rescue Plan Act allocates just under $10 billion to the Homeowner Assistance Fund, which you can apply for and receive benefits from if you qualify. The purpose of the Homeowner Assistance Fund (HAF) is to prevent mortgage delinquencies and defaults, foreclosures, loss of utilities or home energy services, and displacement of homeowners experiencing financial hardship after January 21, 2020. Funds from the HAF may be used for assistance with mortgage payments, homeowner’s insurance, utility payments, and other specified purposes. The law prioritizes funds for homeowners who have experienced the greatest hardships, leveraging local and national income indicators to maximize the impact.

mtierney said:

I confess my narrow understanding of high finance, but might the government be remiss in not targeting the universities which feel the sky’s the limit re tuition costs?

The Student Loan situation is merely a symptom of a larger disease. College degrees have become the bare minimum for almost all jobs in the US. Deregulated high-interest student loans that cannot ever be defaulted are being handed out like candy to 18 year-olds. Colleges can charge whatever they want, because they get the money upfront and don't have to deal with the student paying it back. As such, it has turned the American way of life into a marathon race, with the poorest Americans starting out after college with massive weight tied to their feet.

ridski said:

mtierney said:

I confess my narrow understanding of high finance, but might the government be remiss in not targeting the universities which feel the sky’s the limit re tuition costs?

The Student Loan situation is merely a symptom of a larger disease. College degrees have become the bare minimum for almost all jobs in the US. Deregulated high-interest student loans that cannot ever be defaulted are being handed out like candy to 18 year-olds. Colleges can charge whatever they want, because they get the money upfront and don't have to deal with the student paying it back. As such, it has turned the American way of life into a marathon race, with the poorest Americans starting out after college with massive weight tied to their feet.

Student loans should not have any sort of bankruptcy protections. That would help with one problem.

The fact that college is the new high school will be harder to solve. We could start by not overselling college. There are a lot of jobs in the trades that pay rather well if that is what a person wants to do.

Does anyone know: for people who will still have a balance remaining on their loan(s) after applying the $10/$20K relief, will the monthly payment be recalculated based on the new lower balance, or will they just keep making the same monthly payment, but for fewer months? Would this change the effect (if any) on inflation?

Honestly, I would have been just as happy to see other changes for people who currently have student debt, eg, access to lower market rates via some kind of refi, or access to payment plans that are available to new borrowers (income-based payments, or % of income arrangements where both parties have some risk). That kind of change would not have made such a splash, for better AND for worse.

As far as equity, and Why should working people pay for your degree in arts, or whatever, I was glad to learn that at least some of the forgiven debt is for trade/tech/vocational schools, in addition to the 2 or 4 year colleges. Anybody know how much?

More specifics on student loan debt forgiveness are explained in this article…

Excerpts…

The cost of college in the United States has soared in the last few decades. The average American student owes $28,950 after college, adding up to a total of $1.75 trillion in student loan debt across the nation.

Last July, Speaker of the House Nancy Pelosi said that "people think that the President of the United States has the power of debt forgiveness. He does not. He can postpone, he can delay, but he does not have that power. That has to be an act of Congress."

Pelosi issued a statement praising the proposal last week, but critics across the political spectrum are saying the benefits of Biden’s plan will come at the cost of higher inflation and steeper taxes.

Jason Furman, former Chairman of President Obama’s Council of Economic Advisors (CEA) and a professor of economics at Harvard University, said Wednesday, “Pouring roughly half trillion dollars of gasoline on the inflationary fire that is already burning is reckless.”

mtierney said:

More specifics on student loan debt forgiveness are explained in this article…

Excerpt…

Last July, Speaker of the House Nancy Pelosi said that "people think that the President of the United States has the power of debt forgiveness. He does not. He can postpone, he can delay, but he does not have that power. That has to be an act of Congress."

Pelosi issued a statement praising the proposal last week, but critics across the political spectrum are saying the benefits of Biden’s plan will come at the cost of higher inflation and steeper taxes.

Jason Furman, former Chairman of President Obama’s Council of Economic Advisors (CEA) and a professor of economics at Harvard University, said Wednesday, “Pouring roughly half trillion dollars of gasoline on the inflationary fire that is already burning is reckless.”

They're all wrong.

So that's good.

Like Lot, and looking back up the thread a bit to my earlier comments re Crusades and medieval pogroms, today’s seen this timely archaeological article from Norwich:

https://www.bbc.com/news/uk-england-norfolk-62731151

I’m going to have to search Time Team for Info on the original ‘dig’ for this, it’s really got me intrigued. I know some of the history but the dig account will fill in more..

mtierney said:

More specifics on student loan debt forgiveness are explained in this article…

Excerpts…

Jason Furman, former Chairman of President Obama’s Council of Economic Advisors (CEA) and a professor of economics at Harvard University, said Wednesday, “Pouring roughly half trillion dollars of gasoline on the inflationary fire that is already burning is reckless.”

I'm not an economist, but unlike Jason Furman I know that if someone has $10,000 of debt forgiven, that doesn't mean that they have $10,000 that they can go out and immediately spend.

https://www.nationalreview.com/2022/08/bidens-student-loan-wipeout-sticks-it-to-the-poor/

nohero said:

I'm not an economist, but unlike Jason Furman I know that if someone has $10,000 of debt forgiven, that doesn't mean that they have $10,000 that they can go out and immediately spend.

Do you mean to say that a check for $10k is going straight to the college that overcharged and oversold the degree? I bet there are college students frolicking in an off- campus tavern right now who don’t realize that the lender gets the dough!

mtierney said:

https://www.nationalreview.com/2022/08/bidens-student-loan-wipeout-sticks-it-to-the-poor/

nohero said:

I'm not an economist, but unlike Jason Furman I know that if someone has $10,000 of debt forgiven, that doesn't mean that they have $10,000 that they can go out and immediately spend.

Do you mean to say that a check for $10k is going straight to the college that overcharged and oversold the degree? I bet there are college students frolicking in an off- campus tavern right now who don’t realize that the lender gets the dough!

The check goes to the lender.

Which colleges overcharge and why?

mtierney said:

https://www.nationalreview.com/2022/08/bidens-student-loan-wipeout-sticks-it-to-the-poor/

nohero said:

I'm not an economist, but unlike Jason Furman I know that if someone has $10,000 of debt forgiven, that doesn't mean that they have $10,000 that they can go out and immediately spend.

Do you mean to say that a check for $10k is going straight to the college that overcharged and oversold the degree? I bet there are college students frolicking in an off- campus tavern right now who don’t realize that the lender gets the dough!

No, I don't mean to say that. Nobody is sending a check to any college students or college graduates.

If you misunderstand the issue that much, you should read more about it.

mtierney said:

Do you mean to say that a check for $10k is going straight to the college that overcharged and oversold the degree? I bet there are college students frolicking in an off- campus tavern right now who don’t realize that the lender gets the dough!

College got paid. The student has $10k wiped off their ledger. That's it. If a college student thinks they're getting the money, then maybe they should be in remedial classes.

mjc said:

Does anyone know: for people who will still have a balance remaining on their loan(s) after applying the $10/$20K relief, will the monthly payment be recalculated based on the new lower balance, or will they just keep making the same monthly payment, but for fewer months?

IIRC, if someone randomly paid $10k into your mortgage the payments would remain the same, but your principle would go down, shortening the amount of payments you will need to make to clear the debt/interest. Does that sound right?

Added interest to this post, as there are plenty of former students out there who have paid what they borrowed a long time ago and are still trying to clear the interest.

ridski, yes, that's how it worked with our mortgage (though it wasn't some kind other party making the extra payment). Wouldn't that mean no immediate relief for these borrowers, no increase in spendable money till the loan is paid off? So for those people, there would be no immediate, "inflationary" increase in spending.

ridski said:

IIRC, if someone randomly paid $10k into your mortgage the payments would remain the same, but your principle would go down, shortening the amount of payments you will need to make to clear the debt/interest. Does that sound right?

Added interest to this post, as there are plenty of former students out there who have paid what they borrowed a long time ago and are still trying to clear the interest.

If the term of the loan remains the same (same end date), then the interest due with each payment would go down (smaller loan balance), and each payment to pay off the balance could be smaller (again, with a smaller loan balance).

nohero said:

ridski said:

IIRC, if someone randomly paid $10k into your mortgage the payments would remain the same, but your principle would go down, shortening the amount of payments you will need to make to clear the debt/interest. Does that sound right?

Added interest to this post, as there are plenty of former students out there who have paid what they borrowed a long time ago and are still trying to clear the interest.

If the term of the loan remains the same (same end date), then the interest due with each payment would go down (smaller loan balance), and each payment to pay off the balance could be smaller (again, with a smaller loan balance).

Well, that would be better, but I was going on the information from this: https://www.thebalance.com/how-a-lump-sum-payment-affects-your-mortgage-5214679

mjc said:

ridski, yes, that's how it worked with our mortgage (though it wasn't some kind other party making the extra payment). Wouldn't that mean no immediate relief for these borrowers, no increase in spendable money till the loan is paid off? So for those people, there would be no immediate, "inflationary" increase in spending.

Depends. If the payments stay the same but there are fewer to make (my model) then there would no immediate increase in cash for the borrower, but if the term stays the same and the payments go down (nohero's model) then the borrower will be a little more rich.

However, according to this nerdwallet article: https://www.nerdwallet.com/article/loans/student-loans/pay-off-student-loans-fast?origin_impression_id=936337a9-2134-44d8-940a-64014a55a02f

"For example, let’s say you owe $10,000 with a 4.5% interest rate. By paying an extra $100 every month, you’d be debt-free more than five years ahead of schedule, if you were on a 10-year repayment plan."

That sounds like my model, rather than nohero's.

ridski said:

mtierney said:

I confess my narrow understanding of high finance, but might the government be remiss in not targeting the universities which feel the sky’s the limit re tuition costs?

The Student Loan situation is merely a symptom of a larger disease. College degrees have become the bare minimum for almost all jobs in the US. Deregulated high-interest student loans that cannot ever be defaulted are being handed out like candy to 18 year-olds. Colleges can charge whatever they want, because they get the money upfront and don't have to deal with the student paying it back. As such, it has turned the American way of life into a marathon race, with the poorest Americans starting out after college with massive weight tied to their feet.

it's crazy how they shove loans at students. My son went to a public university in another state, and a loan amount was already included as a credit on the first tuition bill. We had to actively reject the loan.

Student loans shouldn't receive any sort of protection from personal bankruptcy proceedings. That will stop lenders from pushing loans on people.

Also, it occurs to be that making credit available like this, while theoretically intended to help students who can't afford college, is actually just loading them down with debt.

College admissions people are just acting rationally. They are competing for students and because of student loans, they don't have to compete on cost. So naturally, they put money into doing other things to attract students.

Finally, you have to wonder how other countries keep higher education costs down? Is there, God forbid, government funding of universities?

tjohn said:

Finally, you have to wonder how other countries keep higher education costs down? Is there, God forbid, government funding of universities?

America's a great place, if you can afford it. If you can't afford it, plenty of politicians eager to explain that the reason you can't afford it is those people who are even poorer than you are.

tjohn, isn't there some sense in treating student loans differently for bankruptcy purposes? Not necessarily eternal 100% protection. But if there isn't some special treatment, wouldn't many/most students immediately go into bankruptcy on leaving school, having liabilities way more than assets at that point? Or am i missing something?

mjc said:

tjohn, isn't there some sense in treating student loans differently for bankruptcy purposes? Not necessarily eternal 100% protection. But if there isn't some special treatment, wouldn't many/most students immediately go into bankruptcy on leaving school, having liabilities way more than assets at that point? Or am i missing something?

Perhaps student loans are the answer then. I can see bankruptcy protection for a few years, but these things are a lifelong albatross around the neck or borrowers.

Perhaps the government should help with the cost of state universities and trade schools so that students don't have to go into such heavy debt.

Sponsored Business

Promote your business here - Businesses get highlighted throughout the site and you can add a deal.

If we’re going back to Biblical sources, Old Testament practices have the 7th//50th years cycles of renewal:

"In fact, it dates back (at least) all the way to the Old Testament of the Bible. “Every seventh year you shall practice the remission of debts,” the 15th chapter of Deuteronomy reads. “This shall be the nature of the remission: every creditor shall remit the due that he claims from his fellow.” https://www.marketwatch.com/story/a-yom-kippur-reminder-the-idea-of-debt-forgiveness-dates-at-least-as-far-back-as-the-bible-11631729059

« Does God forgive debt?

Another friend referenced Leviticus 25, where in the Old Testament law the Hebrews are mandated by God to observe a cycle of debt forgiveness every seven years, culminating every 50 years in a “year of jubilee” where debts are canceled and property reverts to its original owners. » https://baptistnews.com/article/on-social-media-the-bible-verses-are-flying-in-a-debate-over-student-loan-forgiveness/#.Yw1YvC1_WhA