Good news! Biden says to hell with deficits!

nohero said:

jimmurphy said:

I'm not sure what to make of this statement from the article:

"...it should be said that in addition to mistaking rising prices for the currency devaluation that is inflation (there’s a difference)..."

The author doesn't define the difference. Perhaps DB can explain?

That's not that hard to understand. Take cars as an example, the "chip shortage" limited supply and prices went up (even for used cars). The deficit is irrelevant to the fact that people are willing to pay more for a car from that reduced supply. How strong the dollar is against other currencies is similarly irrelevant.

I was referring the specific statement that I quoted, not the reasons behind inflation in general.

Of course supply chain. But also pumping trillions of dollars into the economy (which adds to demand and since the budget is in deficit, adds to that deficit) while dealing with a constrained supply situation (reduced supply) due to the disrupted supply chain.

Perfect recipe for inflation. Not a surprise.

jimmurphy said:

drummerboy said:

why should I? I never made that claim. I just said the deficit had nothing to do with it - nothing more, nothing less - and you jumped all over me. Why couldn't you stick to the original subject?

Got it. You can't. Thanks.

are you kidding?

what part of "I never made that claim" don't you understand?

jimmurphy said:

nohero said:

jimmurphy said:

I'm not sure what to make of this statement from the article:

"...it should be said that in addition to mistaking rising prices for the currency devaluation that is inflation (there’s a difference)..."

The author doesn't define the difference. Perhaps DB can explain?

That's not that hard to understand. Take cars as an example, the "chip shortage" limited supply and prices went up (even for used cars). The deficit is irrelevant to the fact that people are willing to pay more for a car from that reduced supply. How strong the dollar is against other currencies is similarly irrelevant.

I was referring the specific statement that I quoted, not the reasons behind inflation in general.

Of course supply chain. But also pumping trillions of dollars into the economy (which adds to demand and since the budget is in deficit, adds to that deficit) while dealing with a constrained supply situation (reduced supply) due to the disrupted supply chain.

Perfect recipe for inflation. Not a surprise.

I guess you missed my post that the deficit went down last year, and will go down even more this year.

meh, mere facts.

Also, why didn't the money dumped into the economy in 2020 cause inflation? Was that not a surprise too?

You need a new armchair.

drummerboy said:

are you kidding?

what part of "I never made that claim" don't you understand?

The claim - "current inflation has nothing to do with deficits."

"The deficit" is nothing but an accounting value - the difference between tax receipts and government spending. "The deficit" increased dramatically due to pumping trillions of dollars into the economy, adding demand, during a time of constrained supply, contributing greatly to inflation.

Yet you say that that it has no effect - nothing to do with inflation.

I'm not seeing how you "never made that claim."

That's what I'd like you to explain.

nohero said:

How strong the dollar is against other currencies is similarly irrelevant.

The RealClearMarkets author maintains that the opposite is true, which was what Jim and I couldn’t understand. It heartens me to hear it’s not that hard, so I’ll keep trying.

jimmurphy said:

drummerboy said:

are you kidding?

what part of "I never made that claim" don't you understand?

The claim - "current inflation has nothing to do with deficits."

"The deficit" is nothing but an accounting value - the difference between tax receipts and government spending. "The deficit" increased dramatically due to pumping trillions of dollars into the economy, adding demand, during a time of constrained supply, contributing greatly to inflation.

Yet you say that that it has no effect - nothing to do with inflation.

I'm not seeing how you "never made that claim."

That's what I'd like you to explain.

this is ridiculous.

My claim is that the deficit did not affect inflation. I make no claim as to whether increased spending did or did not affect inflation, as the evidence so far, to me anyway, is unclear.

More importantly, to your point, when the deficit increased dramatically, in 2020, there was no inflation, and even though trillions were pumped into the economy.

In 2021, the deficit CAME DOWN, (he says yet again, yelling this time) yet there was inflation.

Are you getting this? Cause it's the 3rd time I'm pointing this out to you, yet it doesn't appear to be sinking in.

Also, I'm pretty sure that you don't believe, along with other deficit hawks, that " "The deficit" is nothing but an accounting value". That's far more the MMT view.

last post on the subject, unless jm comes to his senses.

Deficit doesn't affect inflation.

Increased spending may or may not be a contributor to current inflation, but certainly doesn't explain all of it.

And the two are not connected vis à vis inflation.

drummerboy said:

this is ridiculous.

My claim is that the deficit did not affect inflation. I make no claim as to whether increased spending did or did not affect inflation, as the evidence so far, to me anyway, is unclear.

More importantly, to your point, when the deficit increased dramatically, in 2020, there was no inflation, and even though trillions were pumped into the economy.

In 2021, the deficit CAME DOWN, (he says yet again, yelling this time) yet there was inflation.

Are you getting this? Cause it's the 3rd time I'm pointing this out to you, yet it doesn't appear to be sinking in.

Also, I'm pretty sure that you don't believe, along with other deficit hawks, that "he deficit" is nothing but an accounting value". That's far more the MMT view.

First, I am not a deficit hawk.

Second, and calmly, to address your 2020 and 2021 points:

In 2020, Government spending primarily in the form of enhanced unemployment benefits and aid to businesses replaced private spending because people had lost their jobs and service consumption cratered. There was a private demand problem that the government properly stepped in to address. Aggregate demand (public + private) was below pre-pandemic levels even with the government spending. There were no significant supply chain issues yet. This combination is why there was no significant inflation.

In 2021, the economy emerged from the pandemic and new spending in the form of child tax credits and other non-pandemic aid came into play. Unemployment went down dramatically, which improved tax receipts (more money in) and may have had an effect to reduce the annual deficit, but I am virtually certain that expenditures were not down. The deficit was just less-bad. Smaller. So now we have a situation where we have increased aggregate demand when you combine increased private spending (because people are back to work) and increased government spending. Too much demand for the broken supply chain to handle. Inflation ensues.

Had the government not juiced spending in 2021 (lowering that year's deficit), aggregate demand would have been reduced and the resultant inflation we're experiencing would have been tamer. There would have been a better balance between supply and demand.

(Let me point out that I didn't say that the government spending was "bad". The child tax credits for example put money in the pockets of people who needed it. An unfortunate byproduct of this has been inflation, but it is worth it.)

Third, and lastly, I *think* you may be using the term "deficit" rather than what I think you may mean which is "aggregate national debt," which might explain some of why we've been talking past each other. I can agree that the "current inflation has nothing to do with the 'aggregate national debt.'"

The reason I won't let this go is because of your (and other progressives') embrace of MMT. The underlying attitude behind your comment that the deficit (which is nothing more than the difference between spending and receipts) has nothing to do with inflation ignores reality. Spending and the timing of that spending matters. Supply and Demand must be in balance or inflation will occur. The MMT answer of controlling inflation through increased taxes is politically ridiculous.

Can we discuss further unemotionally?

jimmurphy said:

First, I am not a deficit hawk.

Second, and calmly, to address your 2020 and 2021 points:

In 2020, Government spending primarily in the form of enhanced unemployment benefits and aid to businesses replaced private spending because people had lost their jobs and service consumption cratered. There was a private demand problem that the government properly stepped in to address. Aggregate demand (public + private) was below pre-pandemic levels even with the government spending. There were no significant supply chain issues yet. This combination is why there was no significant inflation.

In 2021, the economy emerged from the pandemic and new spending in the form of child tax credits and other non-pandemic aid came into play. Unemployment went down dramatically, which improved tax receipts (more money in) and may have had an effect to reduce the annual deficit, but I am virtually certain that expenditures were not down. The deficit was just less-bad. Smaller. So now we have a situation where we have increased aggregate demand when you combine increased private spending (because people are back to work) and increased government spending. Too much demand for the broken supply chain to handle. Inflation ensues.

Had the government not juiced spending in 2021 (lowering that year's deficit), aggregate demand would have been reduced and the resultant inflation we're experiencing would have been tamer. There would have been a better balance between supply and demand.

(Let me point out that I didn't say that the government spending was "bad". The child tax credits for example put money in the pockets of people who needed it. An unfortunate byproduct of this has been inflation, but it is worth it.)

Third, and lastly, I *think* you may be using the term "deficit" rather than what I think you may mean which is "aggregate national debt," which might explain some of why we've been talking past each other. I can agree that the "current inflation has nothing to do with the 'aggregate national debt.'"

The reason I won't let this go is because of your (and other progressives') embrace of MMT. The underlying attitude behind your comment that the deficit (which is nothing more than the difference between spending and receipts) has nothing to do with inflation ignores reality. Spending and the timing of that spending matters. Supply and Demand must be in balance or inflation will occur. The MMT answer of controlling inflation through increased taxes is politically ridiculous.

Can we discuss further unemotionally?

first, I'm not talking at all about aggregate national debt.

secondly, I am not talking about spending, which you continue to do.

third,

"The underlying attitude behind your comment that the deficit (which is

nothing more than the difference between spending and receipts) has

nothing to do with inflation ignores reality. Spending and the timing of

that spending matters. Supply and Demand must be in balance or

inflation will occur."

Not sure what you mean here by "supply and demand must be in balance" but you seem to be implying running a deficit means they're out of balance. So if that's what your saying, this statement is pretty much flat out wrong, since we've been running deficits since forever with no significant inflation.

Not sure why you even keep on bringing up the subject of deficits in this context, other than it seems you're saying too-much-spending increases inflation, and the by-product of the deficit caused by the spending therefore means everything is connected. But they're not, at least vis à vis inflation.

drummerboy said:

first, I'm not talking at all about aggregate national debt.

secondly, I am not talking about spending, which you continue to do.

third,

"The underlying attitude behind your comment that the deficit (which is

nothing more than the difference between spending and receipts) has

nothing to do with inflation ignores reality. Spending and the timing of

that spending matters. Supply and Demand must be in balance or

inflation will occur."Not sure what you mean here by "supply and demand must be in balance" but you seem to be implying running a deficit means they're out of balance. So if that's what your saying, this statement is pretty much flat out wrong, since we've been running deficits since forever with no significant inflation.

Not sure why you even keep on bringing up the subject of deficits in this context, other than it seems you're saying too-much-spending increases inflation, and the by-product of the deficit caused by the spending therefore means everything is connected. But they're not, at least vis à vis inflation.

If you can’t grasp the relationship between spending and the deficit, and its potential impact on inflation, then there’s nothing more to discuss.

Thanks.

jimmurphy said:

drummerboy said:

first, I'm not talking at all about aggregate national debt.

secondly, I am not talking about spending, which you continue to do.

third,

"The underlying attitude behind your comment that the deficit (which is

nothing more than the difference between spending and receipts) has

nothing to do with inflation ignores reality. Spending and the timing of

that spending matters. Supply and Demand must be in balance or

inflation will occur."Not sure what you mean here by "supply and demand must be in balance" but you seem to be implying running a deficit means they're out of balance. So if that's what your saying, this statement is pretty much flat out wrong, since we've been running deficits since forever with no significant inflation.

Not sure why you even keep on bringing up the subject of deficits in this context, other than it seems you're saying too-much-spending increases inflation, and the by-product of the deficit caused by the spending therefore means everything is connected. But they're not, at least vis à vis inflation.

If you can’t grasp the relationship between spending and the deficit, and its potential impact on inflation, then there’s nothing more to discuss.

Thanks.

I have no idea why you think I can't grasp the relationship between spending and the deficit. The problem for me is the second clause "and its potential impact on inflation", assuming "its" is referring to the deficit.

Why you think there is any effect of the deficit on inflation, potential or otherwise, in the face of all contrary evidence, is baffling. And is certainly nothing that you have explained in any of your posts.

Do you think that if spending causes a deficit, and inflation happens to result from the spending, that the deficit is somehow involved too? Because that's ridiculous.

When the fed tries to combat inflation, do they beg the government to balance the budget? Not hardly, in case you don't know the answer.

Frankly, there should have been no discussion after my initial post about the deficit and inflation in response to terp, because I merely stated the obvious. Which you fail to grasp.

smedley - this is not a rabbit hole - this is one person refusing to admit that he's wrong (and it's not me).

The issue of spending should never have come up in response to my first post.

beating a dead horse, maybe.

also as regards to food inflation, I think jm grossly misstates the effect of the child tax credit .

The fact is that poor people probably prioritize their monthly budget on rent and food. Getting an extra $300 per child a month probably results in most of that money going to pay for other expenses. Heard an interview on NPR yesterday with 2 or 3 families and their reactions to losing the tax credit at the end of '21, and no one mentioned food. They talked about being able to pay for child care, or replacing an old decrepit car. Take it for what it's worth.

If someone could provide data that shows that food demand has increased substantially in the last year, I'd be most interested. Because I can't find it.

jm simply assumes it is the case.

Like I said. Thanks.

I won’t engage you on economic issues any more

jimmurphy said:

Like I said. Thanks.

I won’t engage you on economic issues any more

Thank you

drummerboy said:

this is one person refusing to admit that he's wrong (and it's not me).

Despite all your recent evidence that Jim must have come to his senses.

drummerboy said:

last post on the subject, unless jm comes to his senses.

DaveSchmidt said:

drummerboy said:

this is one person refusing to admit that he's wrong (and it's not me).

Despite all your recent evidence that Jim must have come to his senses.

drummerboy said:

last post on the subject, unless jm comes to his senses.

well, he made an effort anyway. still wrong though.

actually, not even wrong, just on some strange tangent.

one of the weirder discussions I've been involved in.

@jimmurphy -- curious if you think substantial inflation was at all avoidable, or was it inevitable as the world economy unfroze?

I don't know if this was raised among the last 40-50 comments, but there is also a hypothesis that all the money that consumers had been spending on experiences like vacations, attending events, etc. went into savings for a year. And then that money was spent on hard goods, driving prices much higher, especially when supply chains were disrupted.

That seems like a fairly simple (and convincing to me at least) explanation as to why prices went up so much in the past year.

ml1 said:

I don't know if this was raised among the last 40-50 comments, but there is also a hypothesis that all the money that consumers had been spending on experiences like vacations, attending events, etc. went into savings for a year. And then that money was spent on hard goods, driving prices much higher, especially when supply chains were disrupted.

That seems like a fairly simple (and convincing to me at least) explanation as to why prices went up so much in the past year.

yes, that's probably part of it.

What I don't understand is the effect of the stimulus on groceries. I just can't imagine that all of a sudden people are buying significantly more groceries than a year ago.

ETA: just to note, what you describe is not necessarily a function of stimulus spending.

jimmurphy said:

nohero said:

jimmurphy said:

I'm not sure what to make of this statement from the article:

"...it should be said that in addition to mistaking rising prices for the currency devaluation that is inflation (there’s a difference)..."

The author doesn't define the difference. Perhaps DB can explain?

That's not that hard to understand. Take cars as an example, the "chip shortage" limited supply and prices went up (even for used cars). The deficit is irrelevant to the fact that people are willing to pay more for a car from that reduced supply. How strong the dollar is against other currencies is similarly irrelevant.

I was referring the specific statement that I quoted, not the reasons behind inflation in general.

Of course supply chain. But also pumping trillions of dollars into the economy (which adds to demand and since the budget is in deficit, adds to that deficit) while dealing with a constrained supply situation (reduced supply) due to the disrupted supply chain.

Perfect recipe for inflation. Not a surprise.

The deficit enables the money supply growth as well as treasuries are what the fed buys to pump $ into the system. You are definitely on the right track.

terp said:

jimmurphy said:

nohero said:

jimmurphy said:

I'm not sure what to make of this statement from the article:

"...it should be said that in addition to mistaking rising prices for the currency devaluation that is inflation (there’s a difference)..."

The author doesn't define the difference. Perhaps DB can explain?

That's not that hard to understand. Take cars as an example, the "chip shortage" limited supply and prices went up (even for used cars). The deficit is irrelevant to the fact that people are willing to pay more for a car from that reduced supply. How strong the dollar is against other currencies is similarly irrelevant.

I was referring the specific statement that I quoted, not the reasons behind inflation in general.

Of course supply chain. But also pumping trillions of dollars into the economy (which adds to demand and since the budget is in deficit, adds to that deficit) while dealing with a constrained supply situation (reduced supply) due to the disrupted supply chain.

Perfect recipe for inflation. Not a surprise.

The deficit enables the money supply growth as well as treasuries are what the fed buys to pump $ into the system. You are definitely on the right track.

yeah, except the deficit shrunk last year and will shrink more this year.

wrong track.

also, the deficit has little to do with money supply growth. You should be well aware of this regarding the Fed's QE program, which did not touch the deficit.

You people still think federal finances work like your checkbook.

drummerboy said:

terp said:

jimmurphy said:

nohero said:

jimmurphy said:

I'm not sure what to make of this statement from the article:

"...it should be said that in addition to mistaking rising prices for the currency devaluation that is inflation (there’s a difference)..."

The author doesn't define the difference. Perhaps DB can explain?

That's not that hard to understand. Take cars as an example, the "chip shortage" limited supply and prices went up (even for used cars). The deficit is irrelevant to the fact that people are willing to pay more for a car from that reduced supply. How strong the dollar is against other currencies is similarly irrelevant.

I was referring the specific statement that I quoted, not the reasons behind inflation in general.

Of course supply chain. But also pumping trillions of dollars into the economy (which adds to demand and since the budget is in deficit, adds to that deficit) while dealing with a constrained supply situation (reduced supply) due to the disrupted supply chain.

Perfect recipe for inflation. Not a surprise.

The deficit enables the money supply growth as well as treasuries are what the fed buys to pump $ into the system. You are definitely on the right track.

yeah, except the deficit shrunk last year and will shrink more this year.

wrong track.

also, the deficit has little to do with money supply growth. You should be well aware of this regarding the Fed's QE program, which did not touch the deficit.

You people still think federal finances work like your checkbook.

I still think you have no idea what you are talking about. BTW: we printed more $$ in the last 2 years than in the history of the fed up until 2 years ago. And we have been running huge deficits. GTFO with this rounding error deficit shrinking. Im not sure what QE doesn't "touch the deficit" means, but they're sure buying a lot of government bonds.

I mean, if they're not careful asset bubbles might form. Waiy. I forgot. We like that kind of inflation...until the bubbles burst of course. Then its deregulation something something.

terp said:

drummerboy said:

terp said:

jimmurphy said:

nohero said:

jimmurphy said:

I'm not sure what to make of this statement from the article:

"...it should be said that in addition to mistaking rising prices for the currency devaluation that is inflation (there’s a difference)..."

The author doesn't define the difference. Perhaps DB can explain?

That's not that hard to understand. Take cars as an example, the "chip shortage" limited supply and prices went up (even for used cars). The deficit is irrelevant to the fact that people are willing to pay more for a car from that reduced supply. How strong the dollar is against other currencies is similarly irrelevant.

I was referring the specific statement that I quoted, not the reasons behind inflation in general.

Of course supply chain. But also pumping trillions of dollars into the economy (which adds to demand and since the budget is in deficit, adds to that deficit) while dealing with a constrained supply situation (reduced supply) due to the disrupted supply chain.

Perfect recipe for inflation. Not a surprise.

The deficit enables the money supply growth as well as treasuries are what the fed buys to pump $ into the system. You are definitely on the right track.

yeah, except the deficit shrunk last year and will shrink more this year.

wrong track.

also, the deficit has little to do with money supply growth. You should be well aware of this regarding the Fed's QE program, which did not touch the deficit.

You people still think federal finances work like your checkbook.

I still think you have no idea what you are talking about. BTW: we printed more $$ in the last 2 years than in the history of the fed up until 2 years ago. And we have been running huge deficits. GTFO with this rounding error deficit shrinking. Im not sure what QE doesn't "touch the deficit" means, but they're sure buying a lot of government bonds.

I mean, if they're not careful asset bubbles might form. Waiy. I forgot. We like that kind of inflation...until the bubbles burst of course. Then its deregulation something something.

I know you have no idea what you're talking about.

And are you talking about the deficit or the national debt? Because I'm talking about the annual deficit, as is jim. As are everyone else when they refer to the federal deficit, except maybe you.

Clarify your terms.

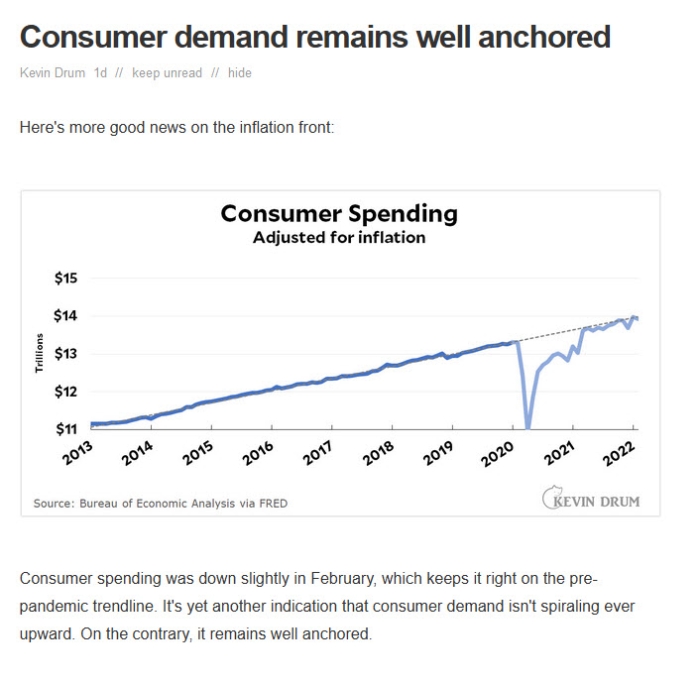

further back in the thread there was a lot of back and forth regarding inflation, with some blaming it on excessive demand due to people spending all the money that Biden pumped into the economy.

I took the stance that this "fact" really wasn't very clear at all and there was no clear indication that consumer spending was significantly higher than it had been before - pandemic effects notwithstanding.

Here's some data supporting my stance

https://jabberwocking.com/consumer-demand-remains-well-anchored/

Let's revisit these arguments that spending doesn't matter when the U.S. dollar is no longer the world's reserve currency.

tjohn said:

Let's revisit these arguments that spending doesn't matter when the U.S. dollar is no longer the world's reserve currency.

Not sure what the connection is between the two.

I'd pay more attention to the deficit scolds if they were adamant that we need to stop spending nearly a trillion dollars a year on the military. Some of them do. But most of them only single out spending that goes to actual people to make their lives better. There's always plenty of money for killing people though.

For Sale

Garage Sales

-

HUGE Rummage sale to benefit the Bloomfield High School Robotics Team Sale Date: Apr 27, 2024

More info

Got it. You can't. Thanks.